In the dynamic landscape of the modern workforce, the concept of digital nomadism has gained momentum, offering individuals the freedom to work from anywhere on the globe. In this exploration of digital nomad jobs, we'll delve into diverse career paths, fully remote companies, freelance opportunities, and the crucial aspect of navigating taxation laws in the nomadic realm.

Jobs that Allow You to Work Remotely: Embracing Location Independence

The digital age has ushered in a new era of work, liberating professionals from the confines of traditional office spaces. Jobs that embrace remote work are diverse, catering to a range of skills and interests. From software engineers and writers to marketing professionals, the spectrum of remote-friendly roles allows individuals to craft a career while exploring the world.

Considerations:

- Wide array of professions embracing remote work.

- Flexibility in choosing roles aligned with skills and passion.

- Global job market accessibility.

Navigating Taxation:

It's essential to understand that the freedom of remote work doesn't necessarily mean a carte blanche to work and earn from anywhere. Navigating taxation laws becomes crucial, as your tax obligations may vary based on your location and the company's legal structure.

If you're seeking a career that transcends geographical boundaries, exploring jobs that facilitate remote work can open doors to a lifestyle where professional fulfillment and global exploration coexist.

Fully Remote Companies: Global Opportunities at Your Fingertips

Overview: The rise of fully remote companies or those embracing remote work has become a game-changer for digital nomads. These companies operate on a global scale, allowing employees to work from anywhere, fostering a culture of inclusivity and diversity.

Considerations:

- Companies with a commitment to remote work culture.

- Access to a global talent pool.

- Opportunities for collaboration with diverse teams.

Navigating Taxation:

Despite the global nature of these companies, understanding the tax implications remains crucial. Tax laws may differ, and compliance is essential to avoid legal complications.

For those aspiring to work in an environment that values flexibility and diversity, exploring fully remote companies can be the gateway to a truly global professional experience.

Freelance Jobs: Embracing Independence and Variety

Freelancing offers a unique avenue for digital nomads to exercise control over their work and lifestyle. Whether you're a writer, graphic designer, or marketing specialist, freelancing allows you to offer your skills on a project basis, giving you the freedom to choose clients and projects.

Considerations:

- Independence in choosing projects and clients.

- Varied skill sets catering to the gig economy.

- Entrepreneurial spirit with a focus on personal branding.

Navigating Taxation:

As a freelancer, understanding the tax implications of working across borders is crucial. Navigating tax laws ensures compliance and a smooth freelance journey.

For those who crave autonomy and variety in their professional journey, freelancing presents an opportunity to shape your career on your terms while enjoying the flexibility of a nomadic lifestyle.

Working for Yourself: Entrepreneurial Ventures Unleashed

The pinnacle of digital nomadism is achieved when individuals venture into entrepreneurship. Building your business allows for ultimate control over your time, projects, and financial destiny.

Considerations:

- Ownership of successful businesses or startups.

- Delegation of tasks to a remote team.

- Financial independence and a strategic approach to time management.

Navigating Taxation:

Entrepreneurial ventures demand a nuanced understanding of international tax laws. Proper planning and compliance are essential to sustain a successful business while navigating the intricacies of global taxation.

For those with a vision to build and scale their ventures while relishing the freedom to explore, the entrepreneurial nomad lifestyle might align with your aspirations for ultimate autonomy.

Closing

The world of digital nomad jobs is expansive, offering opportunities for professionals in various fields to embrace a location-independent lifestyle. However, the freedom to work from anywhere comes with the responsibility of navigating taxation laws, ensuring compliance for a seamless and legal nomadic experience. Whether you choose a remote-friendly role, join a fully remote company, embark on freelancing endeavors, or venture into entrepreneurship, understanding the dynamics of digital nomad jobs and taxation laws is key to unlocking a career that transcends borders.

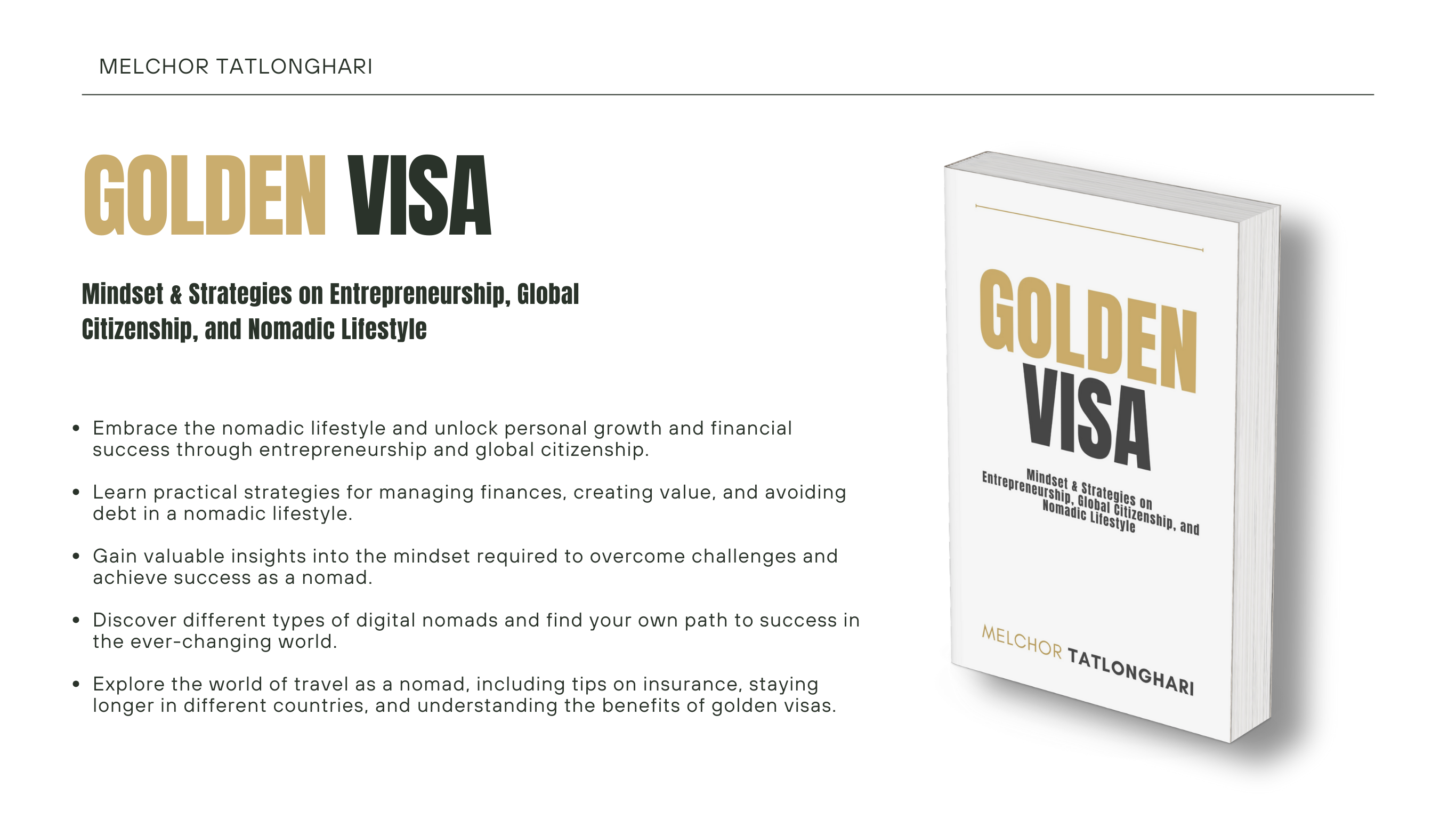

Golden Visa Book

Golden Visa, is a book I wrote that explores the intersection of entrepreneurship, global citizenship, and the nomadic lifestyle. This book provides invaluable insights and practical advice for individuals looking to embrace a new way of living and doing business in today’s rapidly changing world.